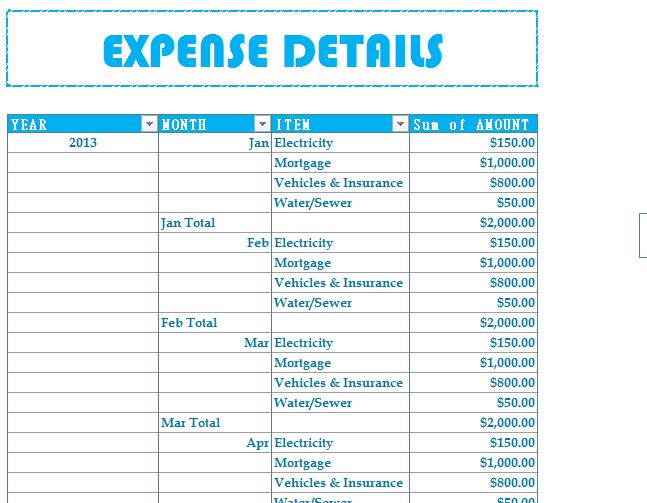

Remember that housing expenses may also include HOA fees, insurance, and taxes. Housing, transportation, utilities, health & fitness, entertainment, groceries, and personal care should all be accounted for in terms of spending categorization. Once you have everything listed in your household budget form, it’s time to categorize different expenses. Once you’ve listed everything, you’ll be able to see how your income compares to your budget.Ĭategorize Your Expenses Photo Courtesy: Getty Images Write down your salary, wages, tips, rent from a roommate, and any other income you receive here. Next to this list, you’ll also need a column for different forms of income you receive. If you pay off your card balance every month but the amount varies widely, you can take the average from the previous three or six months to use as a starting point. If your minimum payment is $100 but you’ve been paying $200 a month for the last few months, write $200 down. When it comes to credit cards, add the minimum payment as an expense, but also include your total balance. It’s difficult to get the full picture for a household budget form if you don’t include bills and expenses that can vary from interval to interval, too. Go through several months of bank statements and credit card bills to gain a better understanding of your spending habits. Keep going with everything from your car to your group fitness classes to your streaming subscriptions. Start with the larger expenses, such as your rent or mortgage payment.

These are bills you pay at structured intervals, such as once a month, with amounts that generally don’t vary too much. The first thing you’ll do when creating your budget is list out all of your regular expenses. To create a simple household budget form, open a spreadsheet on your computer and add several columns. You’ll be one step closer to reaching your financial goals after you create this form.Ĭreate a List for Your Expenses Photo Courtesy: Getty Images Today, we’ll show you how to get started by creating a household budget form that breaks down your finances into different categories for housing, transportation, utilities, and more. Questions like “what should a beginner budget look like?” and “what is a balanced budget?” make this entire process seem very daunting.

After creating a budget, you may be surprised to see where your money’s going - but you’ll be glad you found out.įor most people, the hardest part about budgeting is actually getting started. From saving for a down payment on a new home to paying off debts like student loans, a budget is an amazing tool to help you plan out and track (or even minimize) your spending. Your budget is the financial foundation you need in order to learn how to manage your money before pursuing other financial goals. Budgeting is a pretty consistent buzzword in the world of personal finance - but there’s a good reason for that.

0 kommentar(er)

0 kommentar(er)